Individual Tax Returns Your Complete Guide to ATO Refunds

- Gordon Q.C Du

- Nov 13, 2025

- 6 min read

Lodging your annual Individual Tax Return is a core obligation for Australian residents. This pillar guide provides a comprehensive, high-level overview of the entire process, clarifying the fundamentals, outlining your lodgment options, and explaining how to maximise your resulting tax refund. If you are searching for expert personal tax preparers near me or simply need to understand the core mechanics of lodging your individual income tax return, start here.

I. Defining the Individual Tax Return (ITR)

1. What is an Individual Tax Return ?

The Individual Tax Return (ITR), often interchangeably referred to as a Personal Tax Return, is the formal declaration submitted annually to the Australian Taxation Office (ATO). This process serves as an annual reconciliation where you report all your taxable income earned, claim any allowable deductions, and account for any tax already paid (such as Pay As You Go, or PAYG, from your employer).

It is vital to clarify a common confusion:

Tax Return: This is the document or process of submitting your financial details to the ATO.

Tax Refund: This is the outcome—the money you receive when the ATO determines you have paid more tax throughout the year than your final liability requires.

2. Who is Required to Lodge a Tax Return?

Not every resident needs to file personal tax return, but most do. The requirement to lodge is generally triggered if you:

Exceed the Tax-Free Threshold: Your taxable income is above the tax-free threshold ($18,200 for the current financial year).

Have Taxable Income: You received any income that had tax withheld (like standard salary and wages).

Incur Specific Circumstances: You had income from investments (e.g., rent, dividends, trusts), paid the Medicare levy, or incurred a capital gain (or loss) from selling assets.

It is also important to note the difference between residents and foreign residents for tax purposes, as this significantly impacts the income thresholds and tax rates you are subjected to.

3. The ATO and the Australian Financial Year

The tax system is governed by the Australian Taxation Office (ATO), which oversees compliance and manages the collection of taxes. The annual cycle operates under the Australian Financial Year (FY):

Start Date: 1 July

End Date: 30 June

Lodgment for a financial year typically begins on 1 July. Understanding this timeframe is crucial, as it dictates which income and expenses you must report when you file your personal taxes online or through an agent.

II. The Core Components of Your Tax Return Calculation

The final result of your Individual Tax Return—whether a refund or a tax debt—is determined by three main elements: your taxable income, the deductions you claim, and any tax offsets applied. Understanding how these components interact is key to a correct and compliant lodgment.

1. Taxable Income: What Must Be Declared?

Taxable income is the foundation of your return. You must declare all assessable income you received during the financial year. Common sources include:

Salary and Wages: Income reported by your employer through Single Touch Payroll (STP).

Interest and Dividends: Earnings from bank accounts and investments.

Rental Income: Any gross income derived from investment properties.

Foreign Income: Income earned overseas, which must often be reported, even if it was taxed in another country (due to tax treaties and foreign income tax offset rules).

It is also crucial to account for Capital Gains Tax (CGT), which applies when you sell assets like shares or investment properties. While complex, the gain (or loss) forms part of your total taxable income.

2. Deductions: Reducing Your Taxable Income

Deductions are expenses you incur that directly reduce your taxable income, lowering your overall tax liability. The ATO has strict rules governing what can be claimed. Generally, an expense must:

Have been genuinely incurred by you (you must have spent the money).

Relate directly to earning your income.

Be supported by adequate records (receipts, logs, invoices).

Deductions fall into high-level categories:

Work-Related Expenses: (e.g., travel, home office, self-education).

Cost of Managing Tax Affairs: (e.g., your fee paid to a Tax Agent).

Investment Expenses: (e.g., interest on investment loans, portfolio management fees).

3. Tax Offsets (Rebates)

Unlike deductions, which reduce your taxable income, tax offsets (often referred to as rebates) directly reduce the amount of tax you have to pay. This can significantly increase your tax refund. Common offsets include:

Low Income Tax Offset (LITO) and Low and Middle Income Tax Offset (LMITO) (subject to Government announcements).

Seniors and Pensioners Tax Offset (SAPTO).

Offsets related to private health insurance or dependent care.

The ATO automatically calculates and applies most common offsets based on the information provided in your return.

III. How to File Your Individual Income Tax Return

There are two primary ways to lodge your Individual Tax Return, each with different deadlines and levels of support. Choosing the right method depends on your comfort level with tax matters and the complexity of your financial situation.

1. Lodging Directly with the ATO

The direct method allows you to file personal taxes online using the ATO’s myTax portal, accessed via your myGov account.

Pros: It is free, generally straightforward for simple returns (e.g., standard salary/wages, bank interest), and the ATO pre-fills much of the data from employers and banks.

Cons: You are solely responsible for ensuring accuracy, correctly identifying eligible deductions, and meeting the standard 31 October deadline. This method is not recommended for complex returns involving business income or significant investments.

2. Lodging via a Registered Tax Agent

Using a registered Tax Agent is the preferred method for the majority of Australians. Agents are qualified professionals registered with the Tax Practitioners Board (TPB) who lodge your return on your behalf.

Benefits: Agents ensure accuracy and compliance, often identify deductions you may have overlooked, and—crucially—grant you an extended lodgment deadline, often up to May the following year (provided you are registered as a client before 31 October).

Lodgment: The agent uses specialised software to securely file personal tax return directly with the ATO.

IV. Why Use a Professional Tax Preparer for Your Taxes?

For individuals with more than just a basic wage, engaging a professional personal tax preparer or Tax Agent is often the most cost-effective and secure choice.

1. Maximising Your Individual Income Tax Return

Professional expertise is invaluable for maximising your refund. A Tax Agent ensures that every eligible deduction and offset is claimed correctly, reducing your taxable income to its legal minimum. They stay updated on the latest ATO rulings and changes, ensuring you don't miss out on new entitlements or claim deductions incorrectly, which can flag an audit.

2. Tax Preparers Near Me: The Importance of Local Expertise

While online services are available, connecting with professional personal tax preparers near me offers distinct advantages. A local Australian-based firm provides:

Personalised Advice: Tailored guidance specific to your industry or local investment market.

Accessibility: The option for face-to-face consultations to discuss complex documents and strategies.

This local commitment is key to ensuring that you receive the highest level of service and advice tailored to Australian conditions.

3. Handling Complexities

A Tax Agent becomes essential when your financial circumstances involve:

Investment Property: Calculating depreciation, borrowing costs, and correctly apportioning expenses.

Sole Trader/Contractor Income: Managing GST, business deductions, and PAYG instalments.

Complex Capital Gains/Losses: Accurately applying the CGT discount and loss carry-forward rules.

V. What Happens After You File?

Once your individual income tax return is lodged, the ATO begins processing it. This stage involves validation and the final determination of your tax liability.

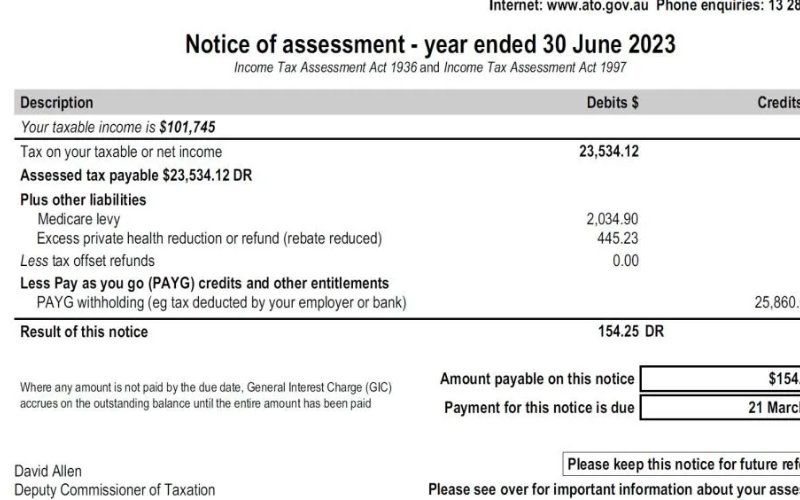

1. The Notice of Assessment (NOA)

The Notice of Assessment (NOA) is the official document issued by the ATO, typically within 14 days of lodgment, confirming the outcome of your tax return. It details:

Your total taxable income.

The total tax payable for the year.

The amount of tax already paid.

The resulting tax refund or tax debt.

The NOA is the final ruling on your submission and should be securely retained for your records.

2. Receiving Your Tax Refund

If the NOA shows you have paid more tax than required, you will receive a tax refund.

Payment: Refunds are typically paid directly into the bank account nominated in your return.

Timeline: While processing times can vary, the ATO generally issues refunds within two weeks for electronically lodged returns.

3. What If You Have a Tax Liability?

If the NOA shows you owe tax (a tax liability), the document will specify the due date for payment. This occurs if you had insufficient tax withheld throughout the year (e.g., due to unadvised second jobs or large capital gains). If lodged through an Agent, they will guide you through this payment process.

Your Tax Journey Starts Here

Lodging your Individual Tax Return is more than just an annual obligation—it's an opportunity to reconcile your finances and ensure you receive every dollar you are legally entitled to. Whether you choose to file personal taxes online using myTax or engage professional personal tax preparers near me, accuracy and timely lodgment are paramount for compliance and peace of mind.

Want to learn more about personal tax?

Explore the related articles below for in-depth insights and practical tips on managing your individual tax obligations.

If you need personalised advice or assistance with your personal tax matters, contact Gordon Q.C Du & Associates — our experienced tax professionals are here to help.

Comments